Introducing Coordinomics

Coordination creates value. Something that costs money if you do it alone, can become cheaper if done in a group. With the right group, it could even become free, or sometimes, become positive-sum, and actually start earning money.

Blockchain transactions. They cost money if you do them alone. But we know that if you take the right transactions and put them together in the right order — if you coordinate them — you can create a little bit of extra value. More than the sum of the parts. Sometimes, a lot more.

And if you manage that value carefully, the transactions can pay for themselves. More often than not, they can actually earn you money. This is the essence of Coordinomics — creating value through coordination.

These facts have some big implications for how we designed our unique form of tokenomics, and the positive flywheel it creates.

The Rook Protocol

The Rook Protocol is the open settlement protocol for DeFi, powered by coordination. Settlement is how orders become transactions recorded in a block on a blockchain. Today, settlement costs users money, but coordination can turn that around and let them start earning money instead.

The process of settlement is technical, but you don't have to be an expert to know that it's not something you can do alone. With blockchains, settlement is designed to be an interaction between different parties playing specialized roles, and guided by different sets of incentives — it is decentralized.

In a vacuum, these parties will work "selfishly" — that is, they will act to maximize their own self-interest (profit). That's okay, and in fact blockchain systems are designed with that in mind. But sometimes these selfish interests misalign, and like two gears grinding together, the settlement process can start to cost the user more and more money.

Coordination fixes this by introducing a higher layer of incentives on top of those that already exist at the consensus layer (the base layer of most blockchains, and the place where the parties involved in settlement typically interact).

These new incentives re-shape the behavior of the parties involved in settlement so that they are now coordinating towards increased settlement efficiency for the user, and decreased MEV extraction for the block producer. These incentives are transmitted between parties in the Rook Protocol by the ROOK token, an ERC-20 token controlled by the Rook DAO.

The ROOK Token

ROOK is a multipurpose ERC-20 token issued by the Rook DAO. It is used throughout the Rook Protocol, serving a mix of utility, governance, and incentive-sharing functions, and has a net deflationary monetary policy with a current total supply of ~1,268,097 ROOK.

Utility ⚙️

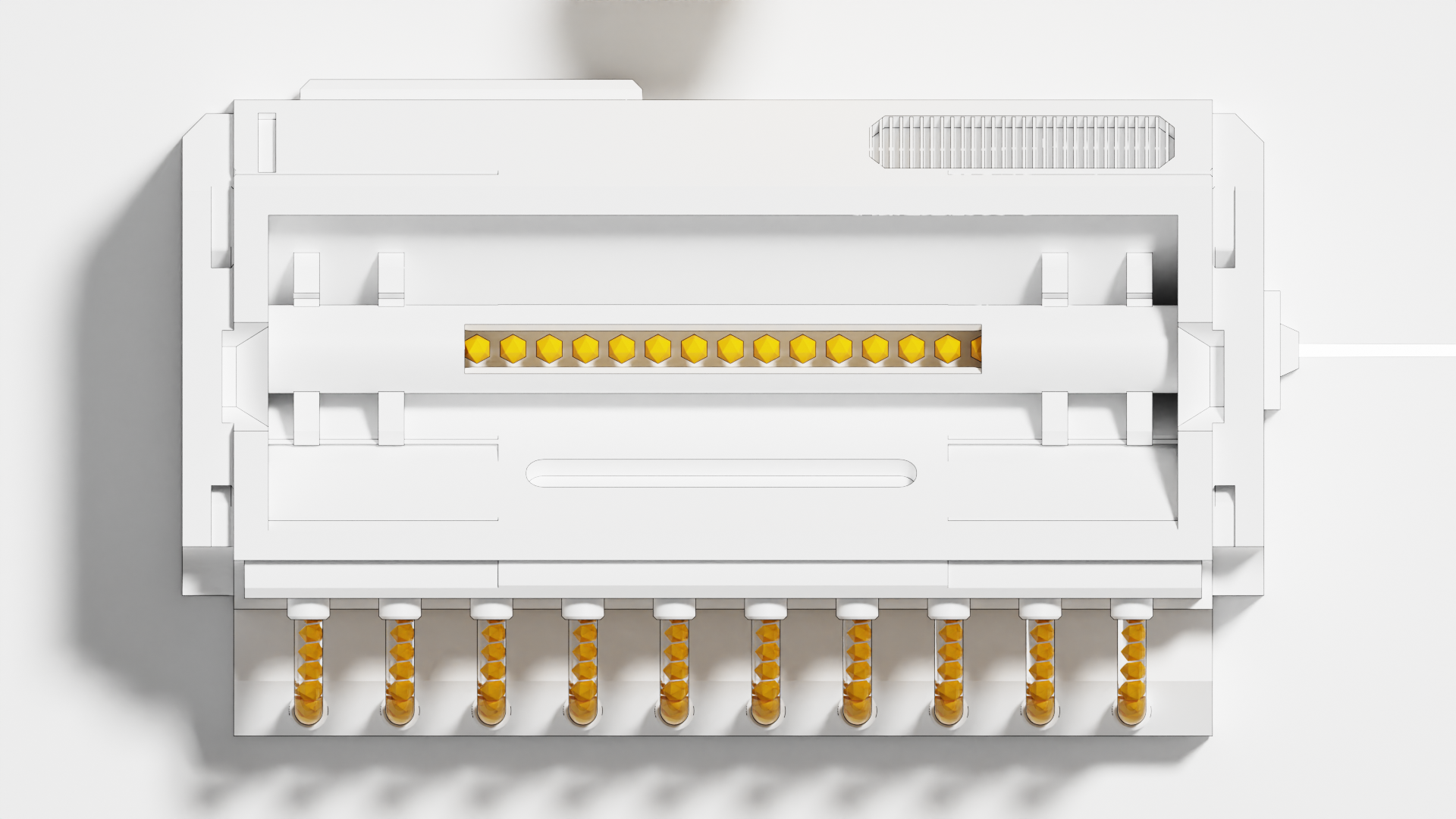

The Rook Protocol utilizes the ROOK token as the basic unit of account for pricing and bidding on the right to settle a transaction.

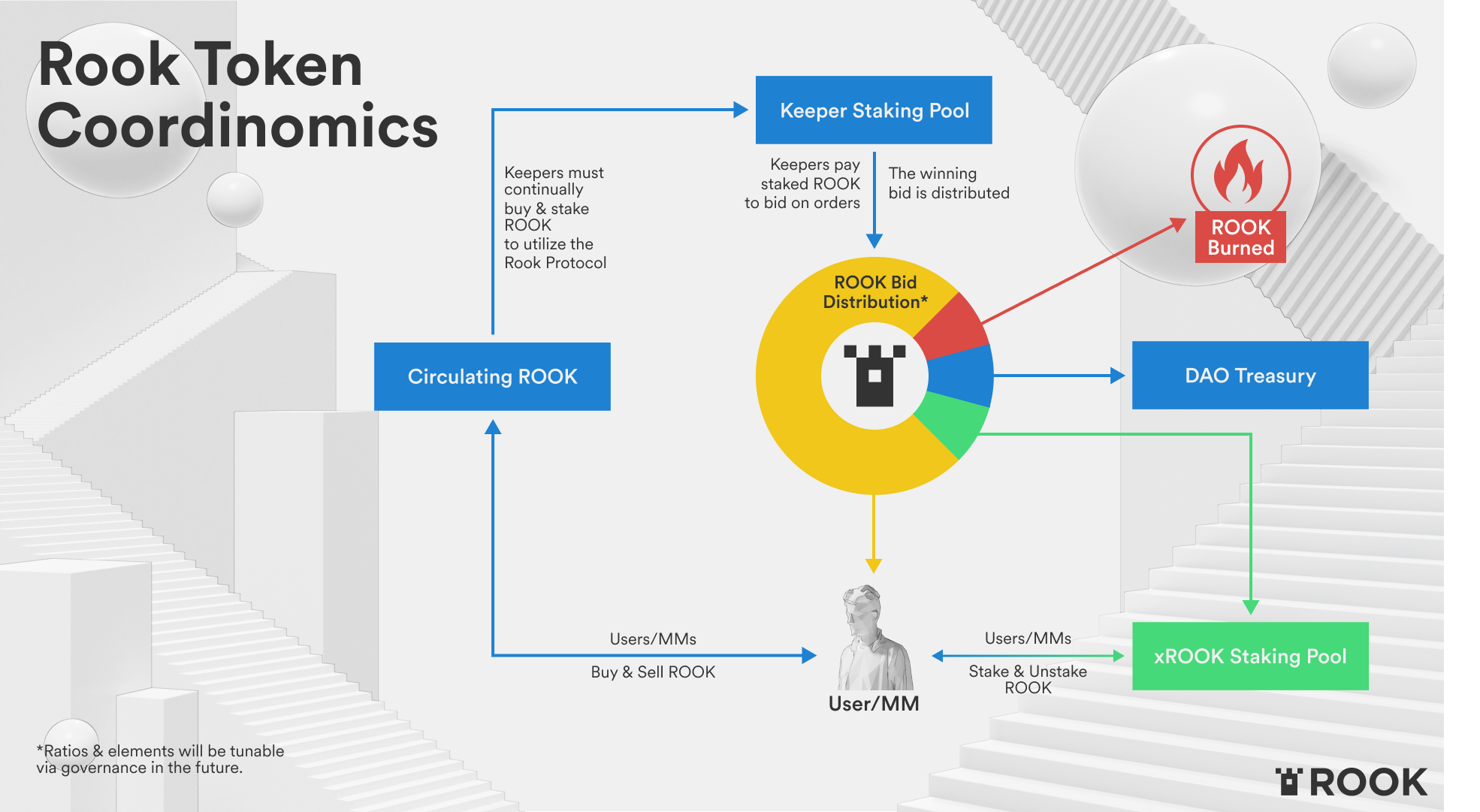

The agents who do this bidding — Keepers — must purchase ROOK and stake it in a Keeper Staking Smart Contract as part of their registration with the Rook Protocol.

Once they have staked ROOK, they may use it to bid for the right to settle transactions over a secure API. If their bid is successful, and they carry out settlement, the ROOK that they bid will flow through the protocol and be distributed to various participants.

This distribution of ROOK is weighted heavily towards the user who originated the transaction being auctioned. This serves as a form of rebate and ensures that value or profit being created through transaction flow, is going back to the people who create it. Other recipients can include the Rook DAO Treasury, or the Rook DAO Staking Pool. It can also be burned.

As they bid on and win auctions, Keepers will draw down their supply of staked ROOK, and will have to re-purchase more on the open market, in order to stake it and continue participating in auctions.

Governance 🏛️

The Rook DAO considers posession of ROOK to determine membership in the Rook DAO. All members of the Rook DAO have a voice in determining the direction of the DAO and its activities, including the stewardship of the Rook Protocol. This is accomplished through Rook DAO Governance, which relies on the ROOK token to signal objection to proposals during a voting procedure.

Rook DAO Governance is unique in that it emphasizes consensus, rather than majority voting. It does not implement standard token-weighted governance, and embraces a flexible and multi-layer governance procedure that gives smaller holders a true voice, and lessens the potential for a dominant voting block to force a particular governance agenda.

Rook DAO Governance oversees and determines many factors, such as whether to certify a Keeper to use the protocol; how to invest the Rook DAO Treasury; how to incentivize the Rook Labs team to continue production of technology beneficial to the Rook DAO; how to distribute incentives in the Rook Protocol, and many other things.

Incentive Sharing 💸

As covered in the utility section, the Rook Protocol distributes ROOK tokens between different parties after each successful transaction settlement.

When you stake your ROOK on the Rook Protocol, you will receive an equivalent amount of xROOK. This is a deposit token that tracks your ownership of the Rook DAO Staking Pool.

As the Rook Protocol sends ROOK into the Rook DAO Staking Pool, the amount of ROOK you can claim for your xROOK goes up. The Rook Trade app makes it simple to track your APR and the number of ROOK you can claim at any time.

Staking ensures that the members of the Rook DAO are aligned behind the success of the Rook Protocol, and incentivized to help it grow in transaction volume over time.

The Coordinomics Flywheel

The ROOK token flows through the Rook Protocol in the following way:

- Keepers must continually buy and stake ROOK from the current circulating supply in order to utilize the Rook Protocol.

- Keepers use their staked ROOK to bid on transactions in an auction.

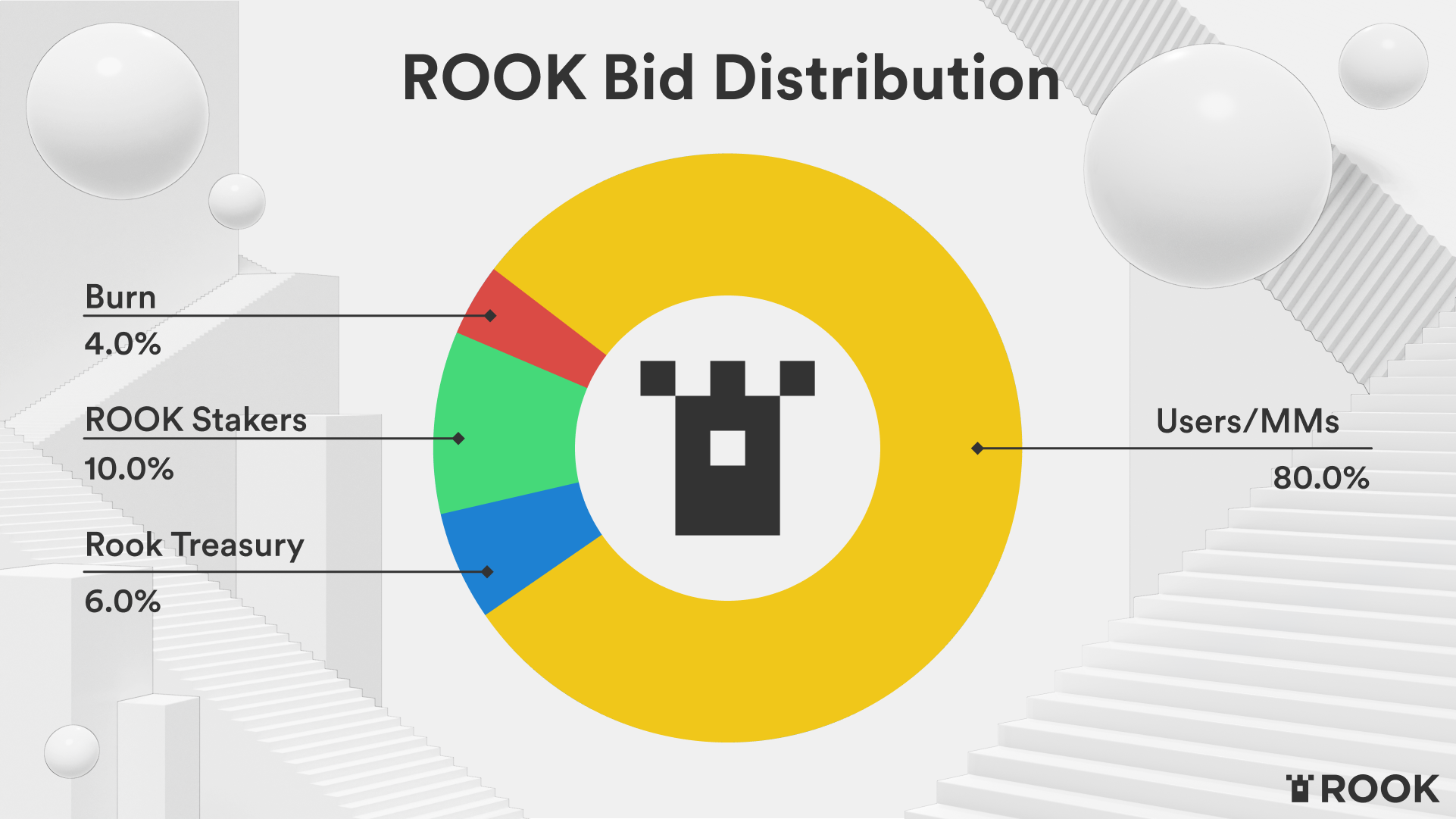

- Once an auctioned transaction is settled to the blockchain, the Rook Protocol distributes the winning bid to four parties, with adjustable weights:

80% to the transaction originator (the user)

10% to Rook DAO stakers

6% to the Rook DAO Treasury

4% burned

Because the protocol issues no new ROOK, and 4% is burned for each transaction settled, the ROOK token is deflationary. The current total supply is 1,268,107 ROOK, and every time a transaction is processed through the Rook Protocol, that number goes down, as a little bit of ROOK gets burned.

The more transaction volume that gets settled through the Rook Protocol, the greater the positive effect of the flywheel.

Interesting effects

- The deflationary nature of ROOK's monetary policy means that those who stake ROOK on the protocol, receive a non-dilutive share of all future protocol revenues, in perpetuity.

- Because a user originating a transaction receives ROOK when their transaction is settled through the Rook Protocol, it's natural to say that "users become owners" of the protocol itself.

- Because the bid paid for each transaction is roughly equivalent to the MEV in the transactions that pass through the Rook Protocol, it's possible to view the Rook Protocol as extracting MEV on behalf of the user.

- This also makes it possible to think of ROOK, and certainly staked ROOK or xROOK, as "tokenized MEV".

The Future is Coordinated

The release of the Rook Protocol represents both groundbreaking new DeFi infrastructure and one of the most interesting new tokenomics designs in the industry.

The ROOK token is now deflationary and productive, able to be staked for sustainable, non-dilutive APR generated by the Rook Protocol. It continues to serve a governance function within the Rook DAO, and provides essential utility for Keepers operating within the protocol itself.

Coordinomics brings Rook Labs' values of co-ownership and putting the user at the center of the experience to life. We’re excited to continue building and elaborating on these incentives, governance, and staking design in the months ahead.

Get involved at Rook

There is a lot to do, and with our recent reorganization, we are always looking for new contributors and community members to join us in our mission to build the open settlement protocol for DeFi.

- Join our Discord: https://discord.gg/rook

- Follow us on Twitter: https://twitter.com/rook

- Visit our Website: https://rook.fi

- Try Rook Trade: https://app.rook.fi