Rook Trade: Make Your Best Move

We are proud to announce Rook Trade, a new platform for professional on-chain trading. Rook Trade lets you reach all liquidity from a single app and trade with fast on-chain limit orders that fill without gas, fees, slippage, and are protected from MEV.

Every trade earns you a Settlement Reward in ROOK. This Settlement Reward is not inflation, and it doesn't come out of the amount you buy or sell in your trade. It is a tip, paid to you by a Keeper for the exclusive right to optimally fill your order on-chain.

Rook Trade is a brand new product that the Rook Labs team couldn’t wait to share with the rest of DeFi. Consider this your direct frontend access to the Rook Protocol and the future of blockchain settlement.

Trade 📈

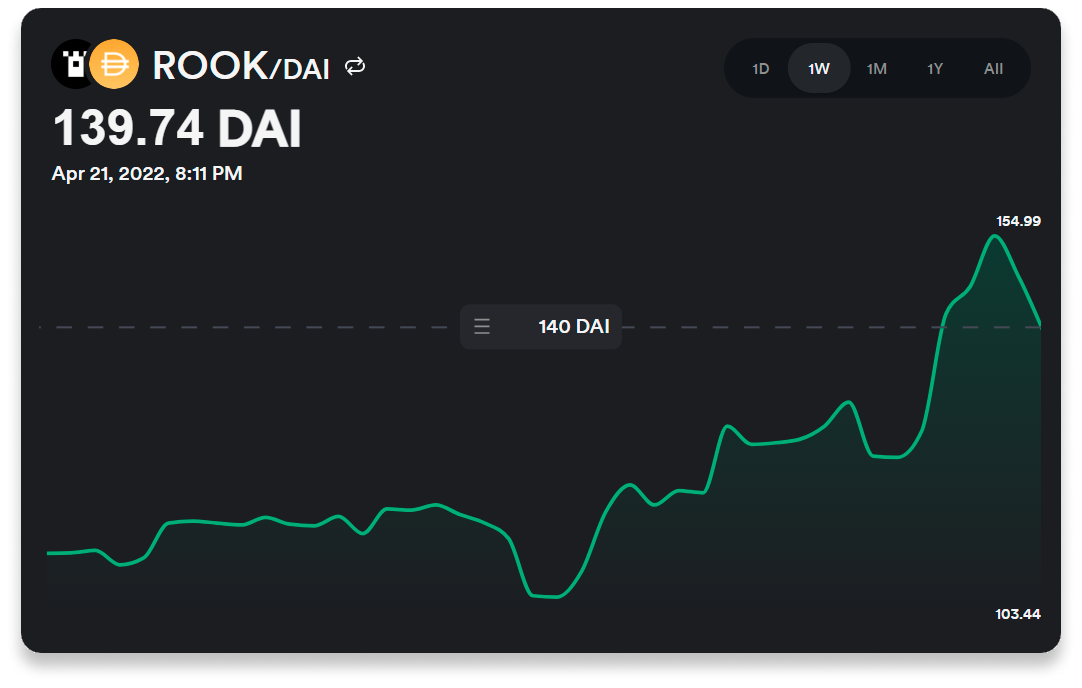

The Trade window remains the best limit order experience in DeFi, but now has a brand new visual UX to match.

- Interactive charts to set and view limit orders

- Set “favorite” pairs and tokens

- View open and historical orders with detailed sortable tables

- Cancel orders without paying gas

- Rebated ROOK is non-inflationary and arrives immediately

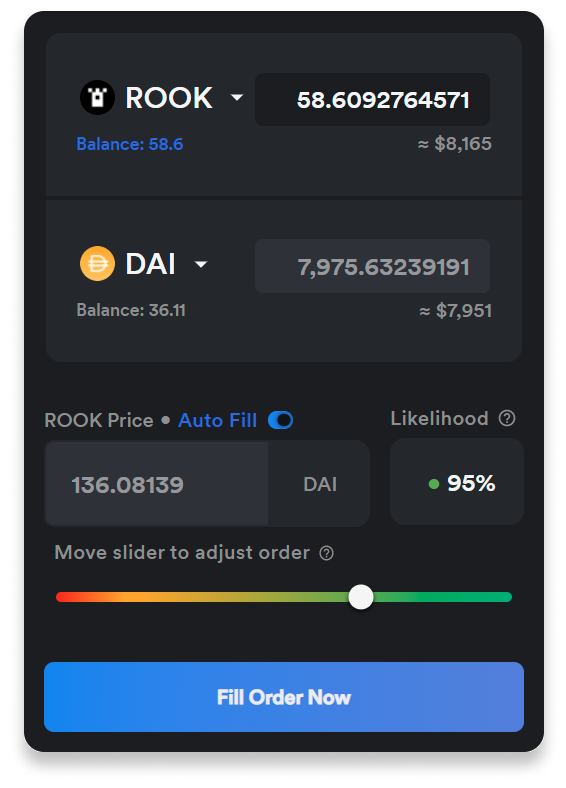

AutoFill 🧲

AutoFill is an experimental new feature for trading with marketable limit orders that fill within 1-3 minutes after being placed.

Instead of selecting a price, you select a probability that your limit order will fill in the next 3 minutes. A machine learning model will then select an appropriate price by factoring in the current market rate for the assets, gas, and historical data about arbitrage and past auction data.

As the protocol gets used, the model will automatically learn the best distributions for all pairs, becoming more and more accurate over time.

Currently AutoFill is enabled only for order sizes $5000 and over.

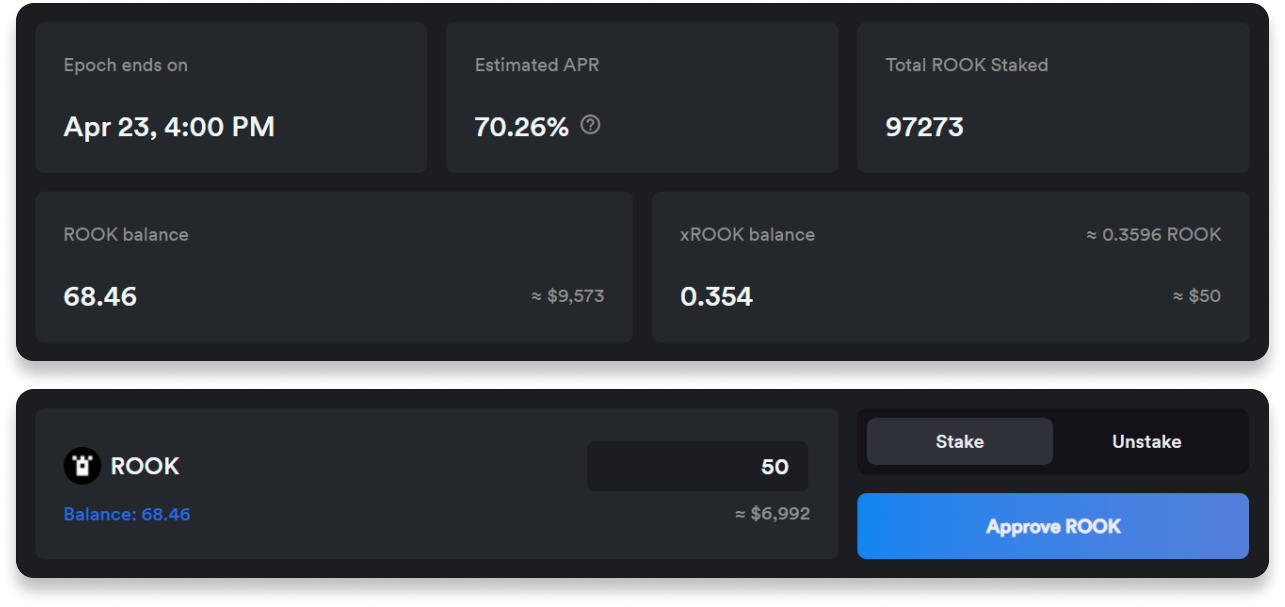

Staking 🏛️

The Stake window lets you stake ROOK directly from the app. You can stake ROOK you’ve purchased on the open market as well as ROOK you get from making trades on the app.

Once your ROOK is staked, it will passively earn additional ROOK from protocol fees and the performance of the Rook DAO Treasury.

Auctions 🏷️

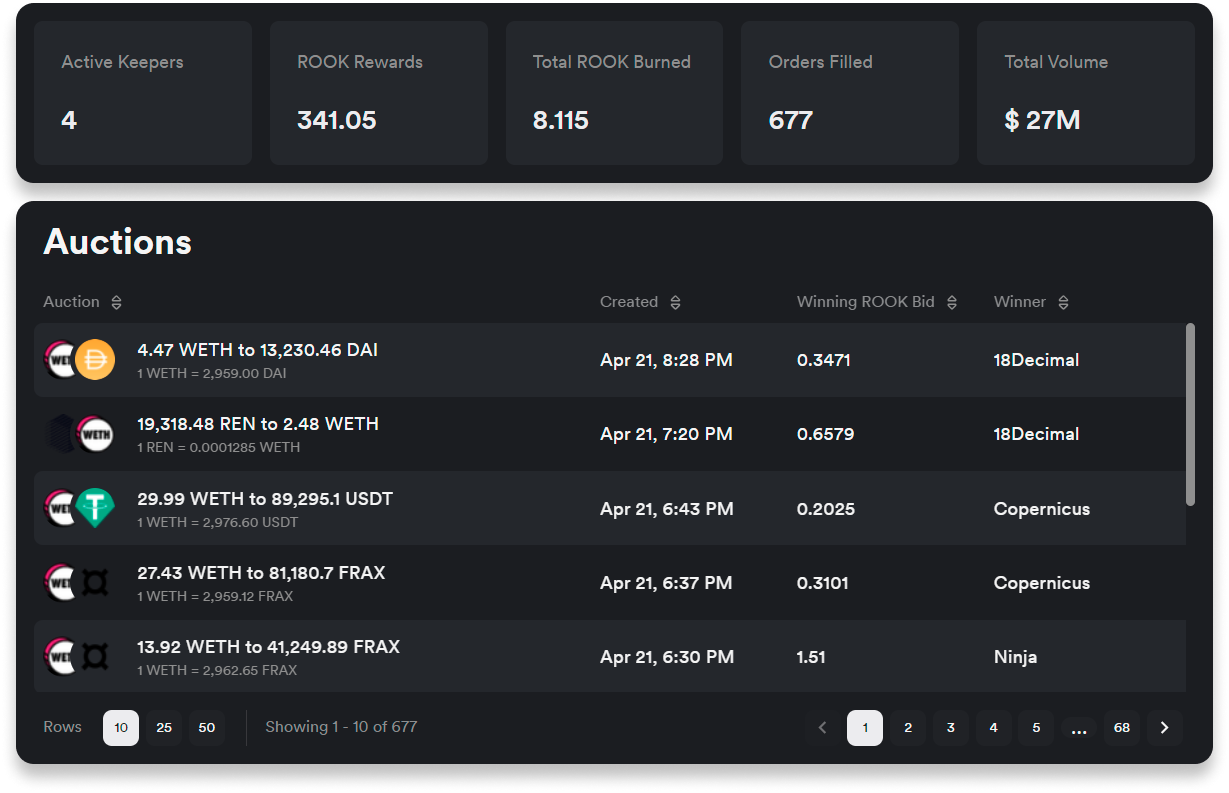

The Auction window lets you lift up the hood and see the Rook Protocol in action. Each transaction processed by the protocol goes through an auction process to determine which Keeper will have the right to settle it on-chain.

Using the Auction window, you can browse past auctions and see what type of transactions are being settled, how Keepers are bidding for them, and more.

- Detailed insight into past auctions and bids.

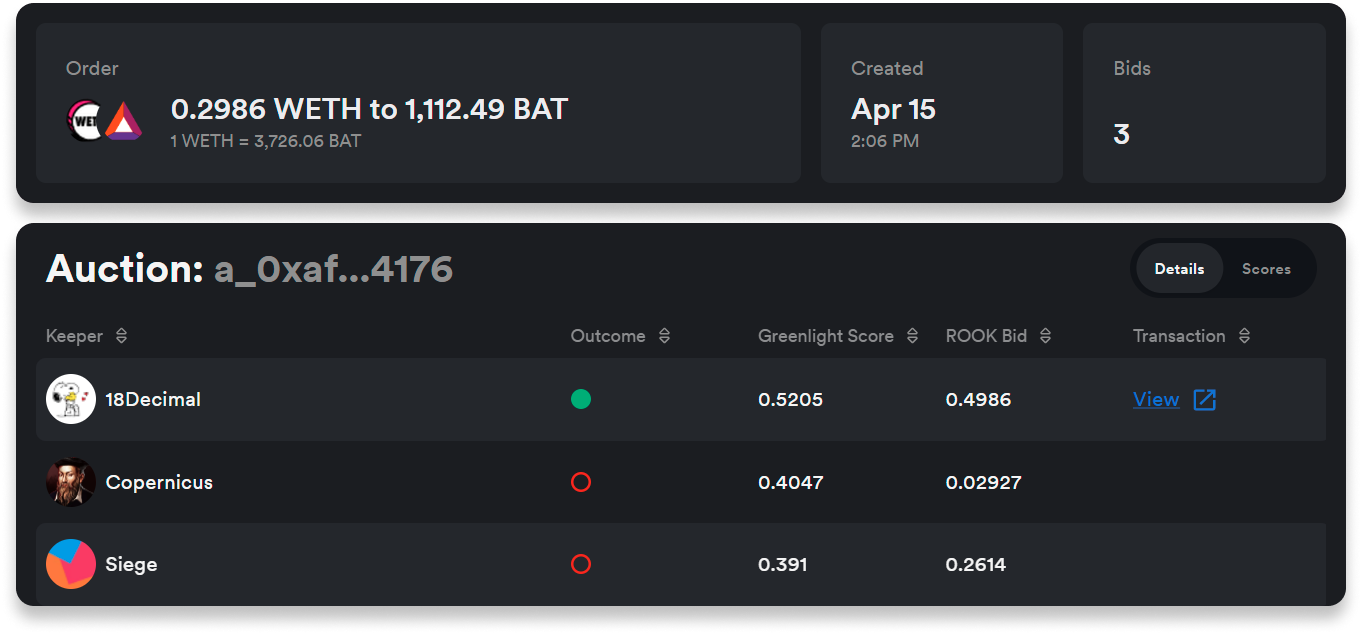

- Breakdown of scores used to determine auction winners.

- Amount of ROOK bid for each bundle.

You can drill down into an individual auction to discover what Keepers participated and what their bids were. You can view all the greenlight algorithm factors, and even an Etherscan link to the resulting transaction.

Leaderboards 🏆

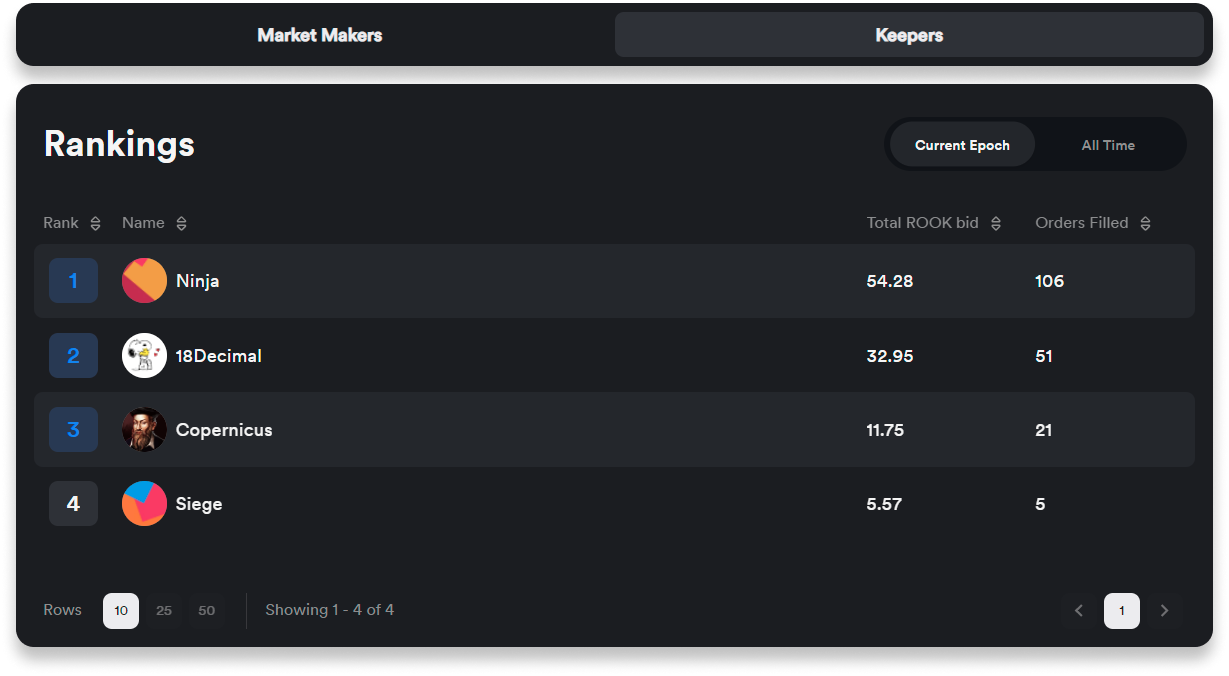

The Leaderboards window lets you track the performance of the Keepers and Market Makers who are directly connected to the Rook Protocol.

By sourcing and providing liquidity, running strategies, and constructing transaction bundles, Keepers and Market Makers help to support the Rook Protocol.

Leaderboards like this one make it easier for the Rook DAO monitor the activity of these important actors, and propose or enact adjustments that will shape their performance and behavior.

New Architecture and Back-end Improvements

We took the bold decision to attack our technical debt and start from scratch, rather than struggle on with the existing codebase. This isn’t always a successful strategy, but we were able to pull it off in a couple of months and start powering forward full speed.

“The Rook Protocol is a quantum leap forward for our infrastructure, and we wanted the trading experience to reflect that inside and out. We started fresh and came back with a totally new codebase that’s built to scale into our continuous improvement strategy.”

— Pangolin, Lead Product Engineer, Rook

The backend architecture supporting the web app was also overhauled, and we added a new Metrics Server and Metrics API to monitor the Rook Protocol and allow us to feed that data into the Rook Trade app. We also added a dedicated backend for the AutoFill machine learning model and quote generation.

The application itself was re-written closer to industry standard frontend practices, allowing a structured workflow and easy on-ramp for new engineers who are already familiar with frontend development. It’s also faster to load, and scalable so that we can continue to monitor and improve performance as we go.

It’s worth noting that the Rook Trade web app provides a user-friendly interface to the Rook Protocol, but it is not the only way to use them. Users can and do also interact directly on-chain or through the Rook Protocol APIs (see https://docs.rook.fi).

What’s Coming Next?

The Rook Trade application, along with the Rook Protocol, has been built for continuous improvement. Expect constant changes, tweaks, upgrades, and quality-of-life features to begin appearing over the coming days, weeks and months.

- More order types, including market orders

- Fully-featured metrics and analytics dashboards directly in the app

- Higher-resolution candlestick charts

- More themes and styling options

- Improved quotes and more execution options

Get involved at Rook

There is a lot to do, and with our recent reorganization, we are always looking for new contributors and community members to join us in our mission to build the open settlement protocol for DeFi.

- Join our Discord: https://discord.gg/rook

- Follow us on Twitter: https://twitter.com/rook

- Visit our Website: https://rook.fi

- Try Rook Trade: https://app.rook.fi

Acknowledgements

Frontend Development Engineers: Pangolin, Ash, Stile, Alleycat

Backend Development Engineers: Pai-Sho, Perry_The_Platypus

Product Designers: Rama, Markoxvee